Review Netflix MADOFF: The Monster of Wall Street Netflix

“Madoff: The Monster of Wall Street” allows experts and witnesses to tell the story, intercut with a few too many recreations for my taste, but this is admittedly dry material that Berlinger and his team try here to make more engaging. They wisely give a ton of time in interview segments to Diana B. Henriques, the author of The Wizard of Lies, who clearly knows this story like the back of her hand. She knows how to give viewers all the necessary details without making it feel like homework. Premiere on 4th January 2023, here is a detailed review of this movie.

She’s also, like most of the people involved, righteously angry at a system that failed on so many levels. The number of times that Madoff should have been caught is ludicrous—it sometimes felt like he was committing crimes in plain sight—and the government ignored the whistleblowers who tried to take him down. The final chapter of this four-episode series focuses on the heartbreaking fallout, including not only what it did to the Madoff family tree but the many investors, including the successful ones who had withdrawn money that the government attempted to reclaim. “Madoff: The Monster of Wall Street” becomes a cautionary tale, reminding us that criminal greed doesn’t always hide in the shadows. Sometimes it’s right in front of a spotlight so bright that it blinds those in charge of stopping it.

Related: What Did Bernie Madoff Do To Build Ponzi Scheme? Simple Explanation

The Madoff scheme “was not a complex fraud,” says forensic accountant Bruce Dubinsky. “It involved simply taking people’s money [and] telling them he was going to invest their money. And he never did.” For years no one caught on, or so it seemed. Among the major points Mr. Berlinger makes accessible and unavoidable is that the Madoff operation should have been—and very likely was—detected as a crime-in-progress years before it was dragged naked into the daylight by the 2008 financial crisis (a point at which Madoff could no longer call on his biggest investors for cash to cover his shortfall). Mr. Markopolos was the most insistent of Madoff debunkers. But when journalist Erin Arvedlund (“Too Good to Be True: The Rise and Fall of Bernie Madoff”) wrote about him for Barron’s in 2001, no one whom she spoke to on the trading floors of New York recalled ever having made a trade with Bernie Madoff. That some parties avoided him entirely—Goldman Sachs and Salomon Brothers among them—might have been a tipoff.

“The Monster of Wall Street” will be, to no one’s surprise, a complex series and downbeat story, but one that is told with enormous style and narrative energy. There are quite a few likably chagrined people among the cast—those who worked in the Madoff offices at the “lipstick building” on Third Avenue in Manhattan. Several who weigh in have written what amounts to the historical record on Madoff, including Jim Campbell (“Madoff Talks”) and Diana Henriques (“Wizard of Lies”). Then there’s Madoff himself: When you’re a success on Wall Street, he says in an archival clip, “Your word is your bond.” More laughably cynical words have seldom been spoken.

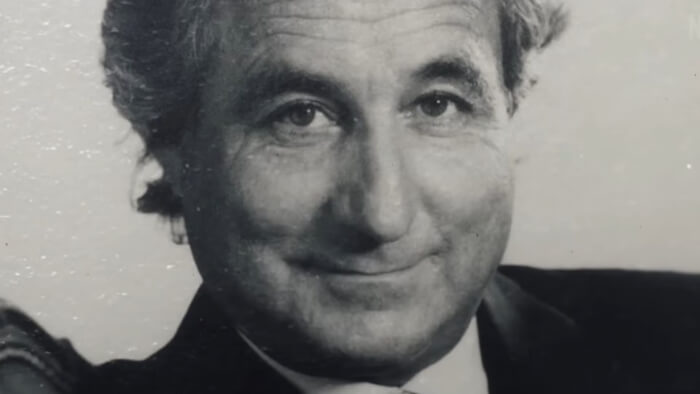

The subject of director Joe Berlinger’s captivating, penetrating, four-part “Madoff: The Monster of Wall Street'' is described by one of its kinder voices as a “financial sociopath.” Later, someone just comes right out and calls him a “serial killer.” All of which may help explain our persistent obsession with the man who perpetrated the largest Ponzi scheme in U.S. history. After so many productions, dramatic and documentary, shouldn’t we be tired of Bernie Madoff? One might as well ask if we’re tired of Charles Manson, or Jack the Ripper.

Aubtu.biz is a website that provides you with sport updates and Entertainment news to brighten your day. Don’t hesitate to visit our site to know more about updated entertainment news.

1. What is MADOFF: The Monster of Wall Street about?

Source: Netflix

Source: Netflix

She’s also, like most of the people involved, righteously angry at a system that failed on so many levels. The number of times that Madoff should have been caught is ludicrous—it sometimes felt like he was committing crimes in plain sight—and the government ignored the whistleblowers who tried to take him down. The final chapter of this four-episode series focuses on the heartbreaking fallout, including not only what it did to the Madoff family tree but the many investors, including the successful ones who had withdrawn money that the government attempted to reclaim. “Madoff: The Monster of Wall Street” becomes a cautionary tale, reminding us that criminal greed doesn’t always hide in the shadows. Sometimes it’s right in front of a spotlight so bright that it blinds those in charge of stopping it.

Source: IMDb

Source: IMDb

Related: What Did Bernie Madoff Do To Build Ponzi Scheme? Simple Explanation

2. Stream or Skip? MADOFF: The Monster of Wall Street review

Source: Leisurebyte

Source: Leisurebyte

The Madoff scheme “was not a complex fraud,” says forensic accountant Bruce Dubinsky. “It involved simply taking people’s money [and] telling them he was going to invest their money. And he never did.” For years no one caught on, or so it seemed. Among the major points Mr. Berlinger makes accessible and unavoidable is that the Madoff operation should have been—and very likely was—detected as a crime-in-progress years before it was dragged naked into the daylight by the 2008 financial crisis (a point at which Madoff could no longer call on his biggest investors for cash to cover his shortfall). Mr. Markopolos was the most insistent of Madoff debunkers. But when journalist Erin Arvedlund (“Too Good to Be True: The Rise and Fall of Bernie Madoff”) wrote about him for Barron’s in 2001, no one whom she spoke to on the trading floors of New York recalled ever having made a trade with Bernie Madoff. That some parties avoided him entirely—Goldman Sachs and Salomon Brothers among them—might have been a tipoff.

Source: Netflix Life

Source: Netflix Life

“The Monster of Wall Street” will be, to no one’s surprise, a complex series and downbeat story, but one that is told with enormous style and narrative energy. There are quite a few likably chagrined people among the cast—those who worked in the Madoff offices at the “lipstick building” on Third Avenue in Manhattan. Several who weigh in have written what amounts to the historical record on Madoff, including Jim Campbell (“Madoff Talks”) and Diana Henriques (“Wizard of Lies”). Then there’s Madoff himself: When you’re a success on Wall Street, he says in an archival clip, “Your word is your bond.” More laughably cynical words have seldom been spoken.

The subject of director Joe Berlinger’s captivating, penetrating, four-part “Madoff: The Monster of Wall Street'' is described by one of its kinder voices as a “financial sociopath.” Later, someone just comes right out and calls him a “serial killer.” All of which may help explain our persistent obsession with the man who perpetrated the largest Ponzi scheme in U.S. history. After so many productions, dramatic and documentary, shouldn’t we be tired of Bernie Madoff? One might as well ask if we’re tired of Charles Manson, or Jack the Ripper.

Aubtu.biz is a website that provides you with sport updates and Entertainment news to brighten your day. Don’t hesitate to visit our site to know more about updated entertainment news.

Share this article

Advertisement