AITA for wanting my girlfriend to pay rent and utilities to live in my house?

' AITA for wanting my girlfriend to pay rent and utilities to live in my house?'

Expert Opinion:

Analyzing the Conflict:

At the heart of this issue is the question of fairness versus obligation. OP sees a 50/50 split as fair since both will be living together, whereas her girlfriend believes that since OP owns the home, she shouldn't have to contribute significantly.

Financial disagreements are among the top reasons couples face relationship strain.

Dr. Terri Orbuch, a relationship expert and author, explains that “money isn’t just about numbers—it’s tied to emotions, power, and security”. OP’s girlfriend views finances through the lens of income fairness, while OP sees it as a shared cost of living.

Financial planner Suze Orman states, “Equity isn’t always about splitting things down the middle; it’s about contributing in a way that feels fair to both partners”. The key to a healthy financial arrangement is open discussion and compromise.

Professional Insights:

Dr. Ramani Durvasula, a clinical psychologist, emphasizes that “financial imbalances can lead to resentment if not addressed with clear communication and agreements”. If OP and her girlfriend don’t align their expectations now, it could lead to long-term conflict.

Many couples use proportional contribution models for financial fairness. A study by the Pew Research Center found that among cohabitating couples, 41% split expenses proportionally based on income. However, contribution models vary based on personal values, financial goals, and lifestyle expectations.

Solutions & Lessons Learned:

- Compromise on Contributions: Instead of a strict 50/50 or 1/6 ratio, they could settle on a more balanced amount, such as a percentage-based split with a minimum contribution.

- Discuss Ownership Expectations: If the girlfriend feels uneasy about paying toward a property she doesn’t own, they could draft an agreement clarifying that her payments go toward living expenses, not home equity.

- Set Clear Financial Boundaries: A written budget outlining each person’s responsibilities can help avoid resentment or misunderstandings.

- Long-Term Planning: If marriage or joint ownership is a future goal, discussing financial commitments now will prevent bigger issues later.

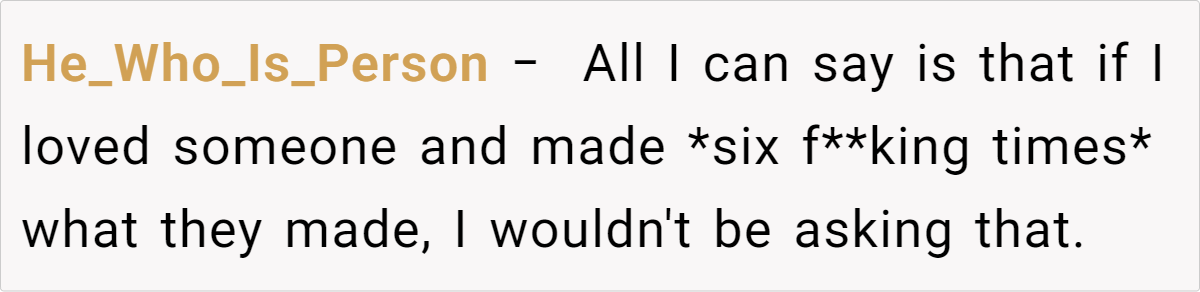

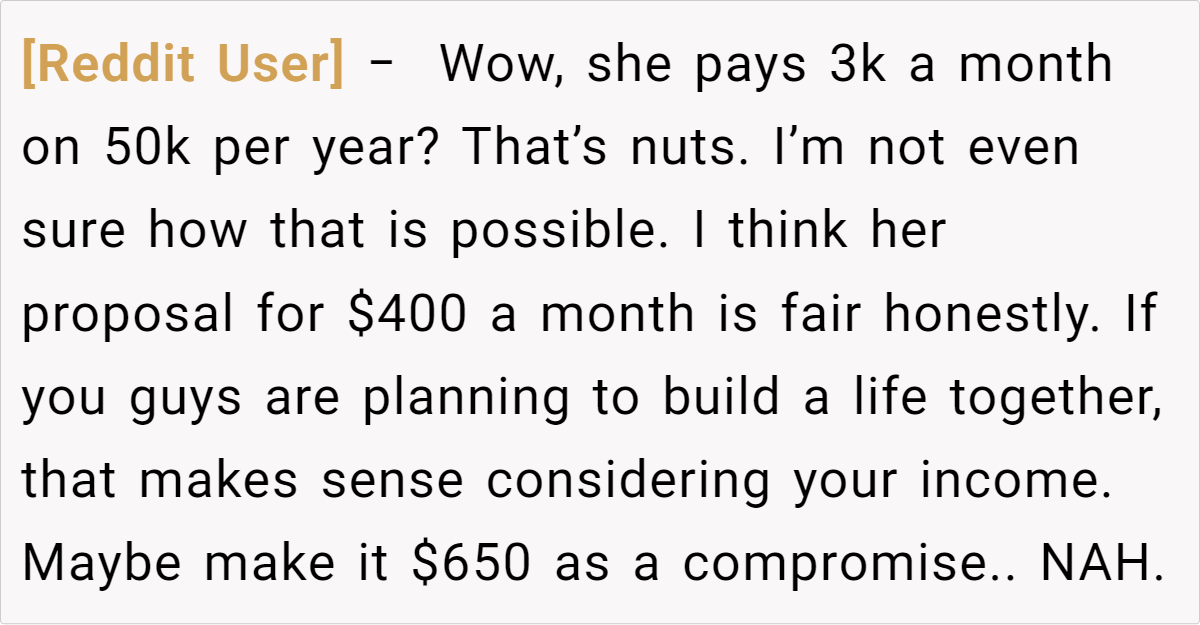

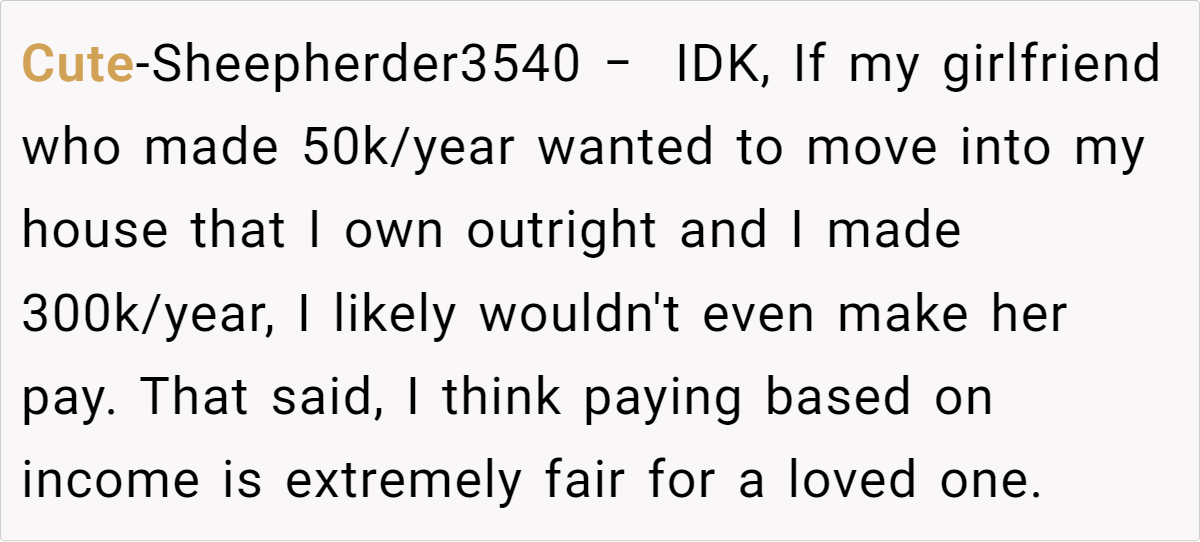

Here's how people reacted to the post:

Do you think the user is justified in wanting her girlfriend to contribute a fair amount to household expenses, or is her girlfriend's perspective about financial contribution based on their income disparity more reasonable? How would you approach financial discussions in a relationship where living arrangements change? Share your thoughts below!