"Swallowing" Foreign Gray Matter, China Dominates The Technology That Worries The US

Electric vehicle (EV) batteries made in China are occupying a large market share in the world, especially in the US market.

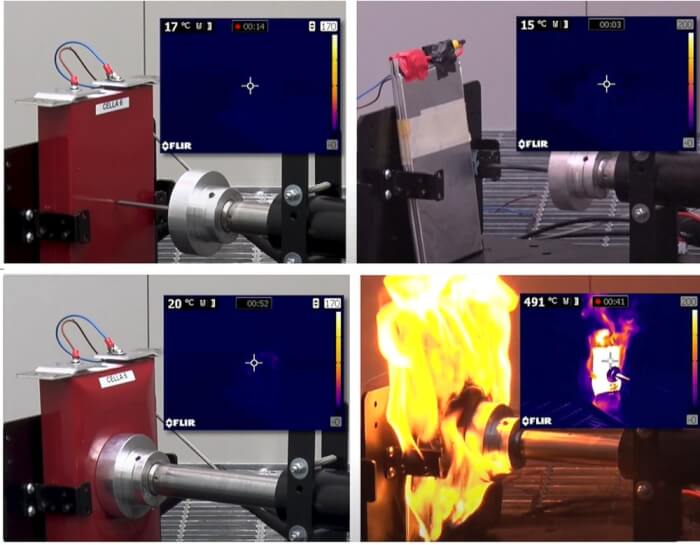

One of CATL’s rival posted a video claiming that technology used by CATL and other manufacturers could cause vehicle fires. Specifically, the video simulated a Chinese fire safety test by piercing a nail through an EV battery. The battery exploded in a fireball.

The change in the law shows China's strong strategy in spearheading the EV battery industry. CATL already supplies batteries to most of the world's automakers, including G.M., Volkswagen, BMW and Tesla. It has also emerged as one of the biggest winners of the electric car boom, alongside Tesla.

China's dominance has stirred fears in the US government that one day the battery industry in the US will become obsolete and Beijing may "control" American vehicles in the 21st century in the way that other oil-producing countries once did to the world in the 20th century.

Bill Russo, former head of Chrysler China and now an electric car consultant in Shanghai, said: "China’s problem with internal combustion engines was they were forever playing the game of catch-up. Now, the United States has to play the game of catch-up with electric vehicles."

Its founder and chairman, Robin Zeng, one of the wealthiest men in Asia, owns a fortune of around $60 billion.

Upon graduating from Shanghai university with a degree in marine engineering, Mr. Zeng went to work on battery chemistry for TDK, a China-based Japanese company. In 1999, he and other battery chemists founded their own company supplying lithium-cobalt batteries for mobile phones, camcorders and other portable consumer electronics. The team sold the company to TDK in 2005 for $100 million and continued to run it as a subsidiary.

Most notably, China requires that foreign automakers which want to sell electric cars in China transfer key technology to a local company. Only then will the government allow foreign companies to sell cars in the Chinese market.

Four years later, another group of Chinese investors bought the remaining 15% from TDK.

TDK currently has a market capitalization of $16 billion, while CATL is valued at nearly $240 billion.

Company records show that within a year of the establishment of CATL, Mr. Zeng established a subsidiary in Qinghai province, western China. Qinghai had one thing Mr. Zeng needed: dried-out salt lake beds with dense underground brine filled with lithium. The government also wanted to see development in the poorer western regions of China.

CATL has benefited greatly from the policy of promoting automakers in China to only use domestically produced batteries.

This effort has also made China a giant in the field of electric car batteries. According to Benchmark Mineral Intelligence, a consulting firm in London, China has 14 times the capacity to produce electric car batteries than the US. China is also expected to keep the lead even after the US ramps up the planned construction of factories in North Carolina.

BYD, which is headquartered in the city of Shenzhen, gets big support from investor Warren E. Buffett. Unlike CATL which invests in lithium-cobalt batteries, BYD bets on traditional lithium batteries.

Yu Bin, a cement mason in Fude, said he recently worked 20 hours straight to finish a roof. "The lights on the cranes stay on all night," he said.

Source: The New York Times

Source: The New York Times

China dominates the global EV battery industry

As the global pandemic hit, the world's largest EV battery manufacturer, Contemporary Amperex Technology (CATL) - a Chinese technology company now worth more than General Motors and Ford combined - suddenly faced a big communications crisis.One of CATL’s rival posted a video claiming that technology used by CATL and other manufacturers could cause vehicle fires. Specifically, the video simulated a Chinese fire safety test by piercing a nail through an EV battery. The battery exploded in a fireball.

Source: YouTube

Source: YouTube

The change in the law shows China's strong strategy in spearheading the EV battery industry. CATL already supplies batteries to most of the world's automakers, including G.M., Volkswagen, BMW and Tesla. It has also emerged as one of the biggest winners of the electric car boom, alongside Tesla.

Source: The New York Times

Source: The New York Times

China's dominance has stirred fears in the US government that one day the battery industry in the US will become obsolete and Beijing may "control" American vehicles in the 21st century in the way that other oil-producing countries once did to the world in the 20th century.

Source: The New York Times

Source: The New York Times

Bill Russo, former head of Chrysler China and now an electric car consultant in Shanghai, said: "China’s problem with internal combustion engines was they were forever playing the game of catch-up. Now, the United States has to play the game of catch-up with electric vehicles."

Out of the shadows

Source: The New York Times

Source: The New York Times

Its founder and chairman, Robin Zeng, one of the wealthiest men in Asia, owns a fortune of around $60 billion.

Upon graduating from Shanghai university with a degree in marine engineering, Mr. Zeng went to work on battery chemistry for TDK, a China-based Japanese company. In 1999, he and other battery chemists founded their own company supplying lithium-cobalt batteries for mobile phones, camcorders and other portable consumer electronics. The team sold the company to TDK in 2005 for $100 million and continued to run it as a subsidiary.

Source: The New York Times

Source: The New York Times

Most notably, China requires that foreign automakers which want to sell electric cars in China transfer key technology to a local company. Only then will the government allow foreign companies to sell cars in the Chinese market.

Source: The New York Times

Source: The New York Times

Four years later, another group of Chinese investors bought the remaining 15% from TDK.

TDK currently has a market capitalization of $16 billion, while CATL is valued at nearly $240 billion.

Beijing's support

Source: The New York Times

Source: The New York Times

Company records show that within a year of the establishment of CATL, Mr. Zeng established a subsidiary in Qinghai province, western China. Qinghai had one thing Mr. Zeng needed: dried-out salt lake beds with dense underground brine filled with lithium. The government also wanted to see development in the poorer western regions of China.

Source: The New York Times

Source: The New York Times

CATL has benefited greatly from the policy of promoting automakers in China to only use domestically produced batteries.

This effort has also made China a giant in the field of electric car batteries. According to Benchmark Mineral Intelligence, a consulting firm in London, China has 14 times the capacity to produce electric car batteries than the US. China is also expected to keep the lead even after the US ramps up the planned construction of factories in North Carolina.

Source: The New York Times

Source: The New York Times

The bet on batteries

CATL holds a third of the global electric vehicle battery market. Its global biggest competitor is LG, with a quarter of the market share. There was a time when CATL also had to face this tough opponent at home.BYD, which is headquartered in the city of Shenzhen, gets big support from investor Warren E. Buffett. Unlike CATL which invests in lithium-cobalt batteries, BYD bets on traditional lithium batteries.

Source: The New York Times

Source: The New York Times

Yu Bin, a cement mason in Fude, said he recently worked 20 hours straight to finish a roof. "The lights on the cranes stay on all night," he said.

Source: The New York Times

Source: The New York Times

Share this article

Advertisement