Is Tesla's success inflating the US stock market's electric vehicle bubble?

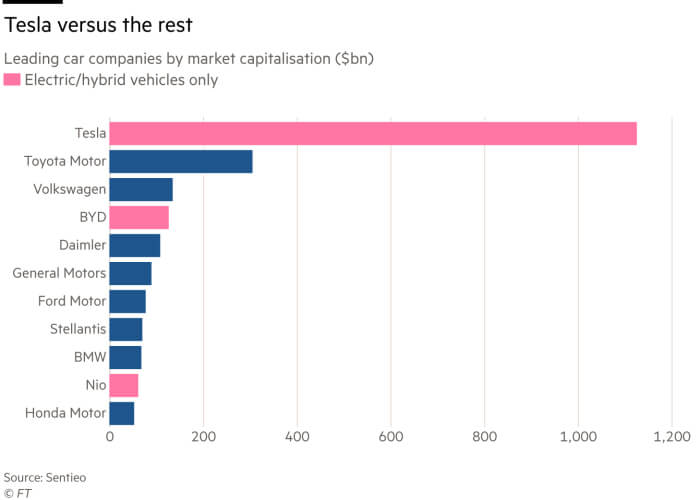

Tesla's impact on the stock market is far greater than its $1.1 trillion market capitalization.

Source: Nasdaq

Source: Nasdaq

According to the Financial Times, Tesla's impact extends beyond these outstanding figures. This is due to a complex network of independent investment tools, a series of businesses copying Tesla's business model, and an active derivatives market.

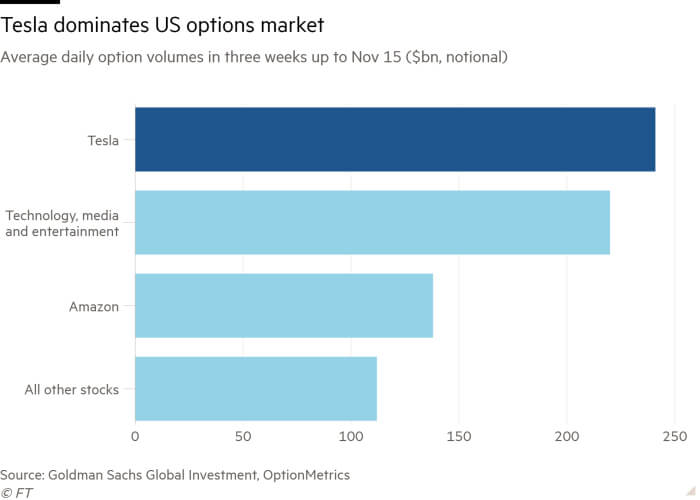

While many individual investors prefer Tesla shares, the sheer magnitude and number of Tesla stock options contracts has never been seen before. According to Goldman Sachs data, the average nominal value of contracts for options on Tesla shares exchanged per day has hit $241 billion in recent weeks. That's nearly twice as much as Amazon's $138 billion per day, the market's second-most traded stock option.

Source: Goldman Sachs Global Investment

Source: Goldman Sachs Global Investment

According to S3 Partners, hedge funds short selling Tesla shares have lost a total of more than 60 billion USD over the last decade, with 11 billion USD lost in the last year alone.

Source: Refinitiv

Source: Refinitiv

The "Electric Vehicle Bubble" ( EV Bubble)

Underscoring its financial idiosyncrasy, Tesla stock tends to not be much affected by other market and economic trends, but correlates somewhat with bitcoin, according to analysis by Quant Insight.At the moment Tesla’s shares seem to be benefiting from a “mixed bag” of factors, such as rising inflation expectations, tighter dollar conditions and uncertain credit markets, but “Tesla spends a lot of time out of [recognisable] macro regimes — unsurprising when it is often driven by idiosyncratic factors like Elon’s tweets,” says Huw Roberts, head of analytics at Quant Insight. A macro regime is industry jargon for how different economic environments can hurt or help certain stocks or sectors.

The success of Tesla’s stock has also helped inflate what some analysts and fund managers think is a broader bubble in anything related to electric vehicles. Tesla-emulators Rivian and Lucid are now valued at about $110bn and $90bn, respectively, despite having negligible revenues and no profits.

An index of EV and electric battery companies compiled by the FT has a combined market capitalisation of almost $1.8tn. In contrast, automotive giants Toyota, Volkswagen and Hyundai, the biggest car manufacturers in the world, are worth about $254bn, $135bn and $42bn, respectively.

“There’s obviously a big halo effect with anything electric vehicle-related at the moment, thanks to Tesla,” says Benjamin Bowler, an equity derivatives strategist at Bank of America.

Source: Sentieo

Source: Sentieo

If Tesla’s ascent continues it will further enrich believers, hurt the dwindling band of doubters and drag swaths of the broader equity market up with it. But if it were to fall sharply, it could cause ripples through financial markets that are far in excess of what many appreciate.

Share this article

Advertisement