20 Pics That Prove That Inflation Is Getting Out Of Hand

If you've just visited planet Earth, you're probably familiar with skyrocketing prices for just about anything. These jumps have exceeded our predictions, escalating already-high U.S. inflation to dangerously high levels.

The May consumer price index (CPI), which monitors increases in the cost of food, petrol, housing, and a variety of other products and services, grew 8.6 percent over the previous 12 months, according to the Labor Department. It's at its greatest level since 1981. And we, the general public, are certainly feeling the strain. While inflation is wreaking havoc on our salaries, they aren't going as far as they once did. It's becoming increasingly difficult to afford to be a person these days, and many people are struggling to make ends meet. They wasted little time in sharing their discoveries with everyone online, looking for a method to vent.

We scoured the internet for the most heartbreaking cases of inflation that had gotten out of hand. Continue scrolling, upvoting the photographs that speak to you the most, and leaving your opinions in the comments! Check out our latest article on shrinkflation if you're seeking for more price-gouging insanity.

Inflation has driven up the cost of groceries, household items, cosmetics, gas, services, and pretty much everything else individuals buy. It is causing an increasing number of Americans to alter their shopping habits. And who are the folks who are the most affected by this? Low-income households are facing the effects of rising income and wealth disparity.

Price spikes, according to Rachel Siegel and Andrew Van Dam of The Washington Post, are especially damaging to people with already tight budgets. The main reason for this is because they spend the majority of their money on necessities like food, electricity, and housing, all of which have suffered significant price rises in the last year.

"Of the 10 categories with the highest levels of pandemic inflation analyzed by The Washington Post, lower earners spent a greater share of their total spending on most of them, from natural gas to beef," they wrote, adding that the highest earners outspent the lowest on cars and furniture.

As a result, lower-income workers are usually only affected by inflation on the negative side. "Their rent will increase. Their heating oil prices are increasing. Their grocery costs are increasing. And they don't have room in their already tight budgets for greater prices. Furthermore, many people have depleted their cash reserves due to the expiration of stimulus benefits and child-tax credit payments."

According to Xavier Jaravel, a professor at the London School of Economics, a minor increase in disposable income is difficult for low-income Americans to live with. "Every additional percentage point of inflation diminishes purchasing power," he noted. "Losing some of your purchasing power is not a major cost if you have a large income, which often goes hand in hand with a lot of saving."

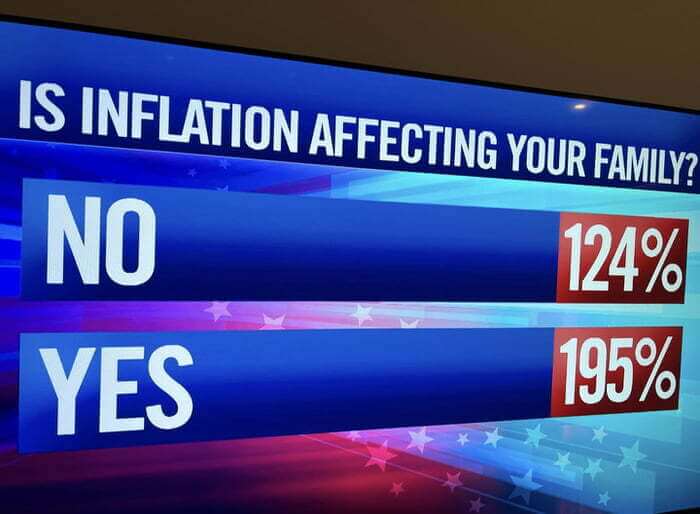

#1 A very helpful graph

#2 Ben and jerry’s is so expensive where i live that they have to put security devices on each pint

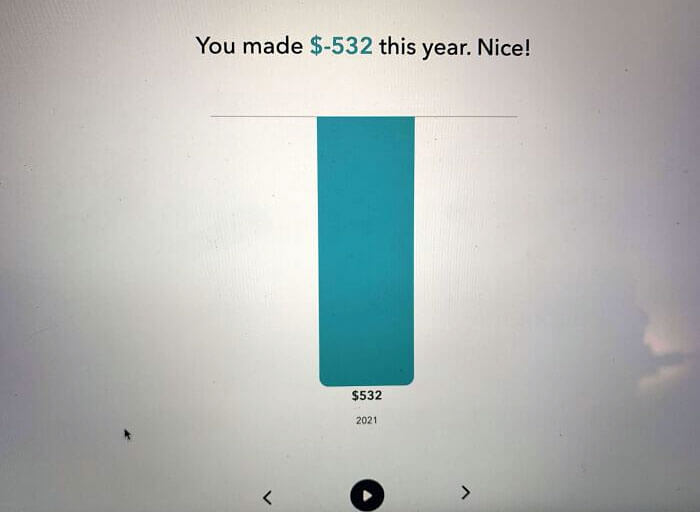

#3 Nice

#4 He was

#5 A one month supply of my son's new cystic fibrosis medicine. at $24,000, it's the most expensive thing i've ever held in one hand

#6 You peel the sticker off to see the original price of $1.99

#7 Walmart is getting real honest with inflation these days

#8 I'm an art teacher - old tube price vs. new

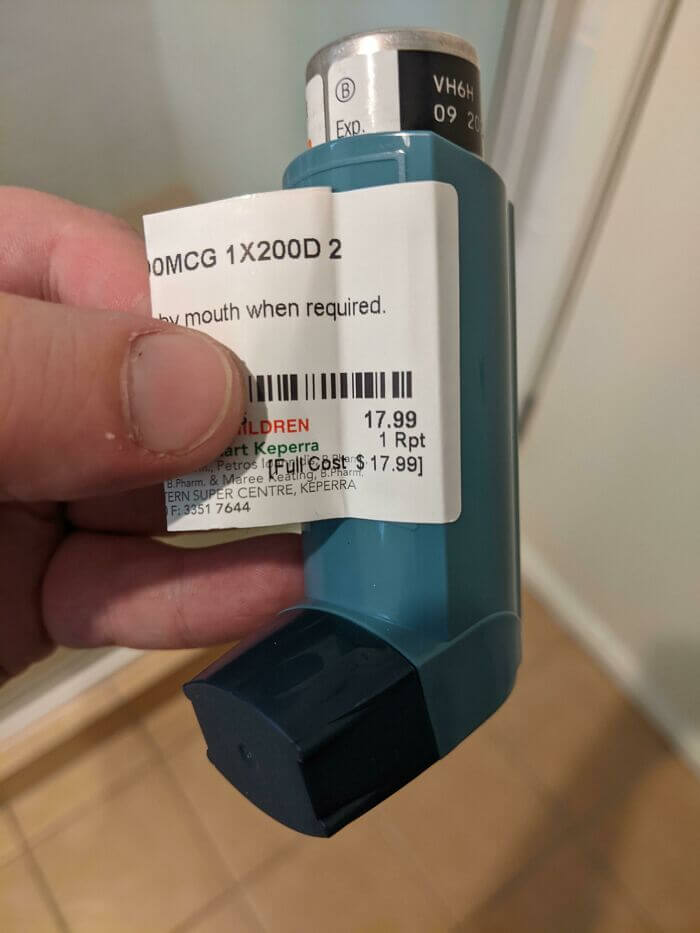

#9 I really need to ration my breathing

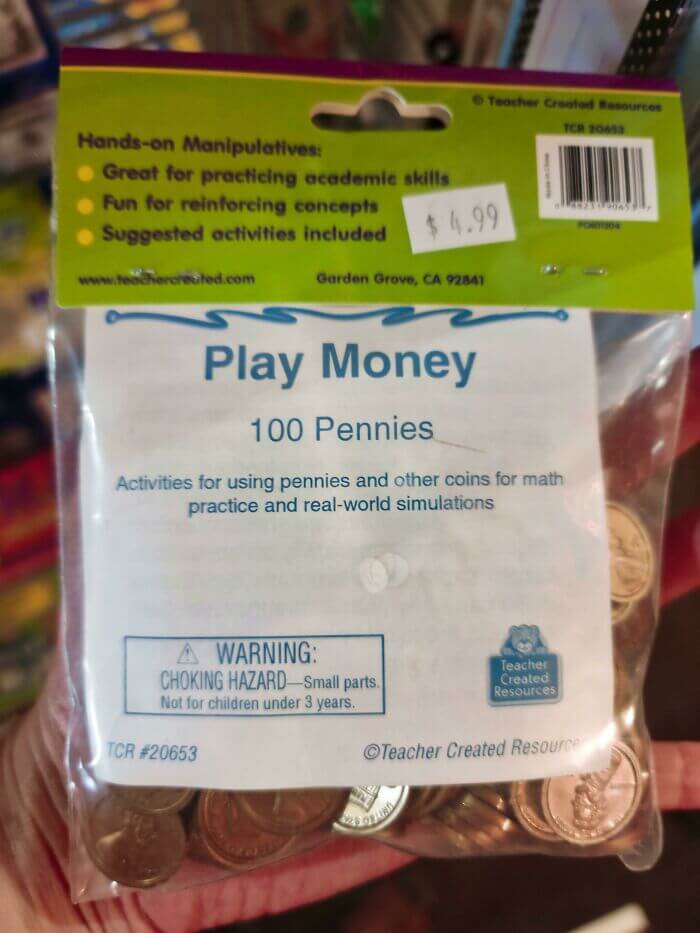

#10 This play monet costs 5x real money

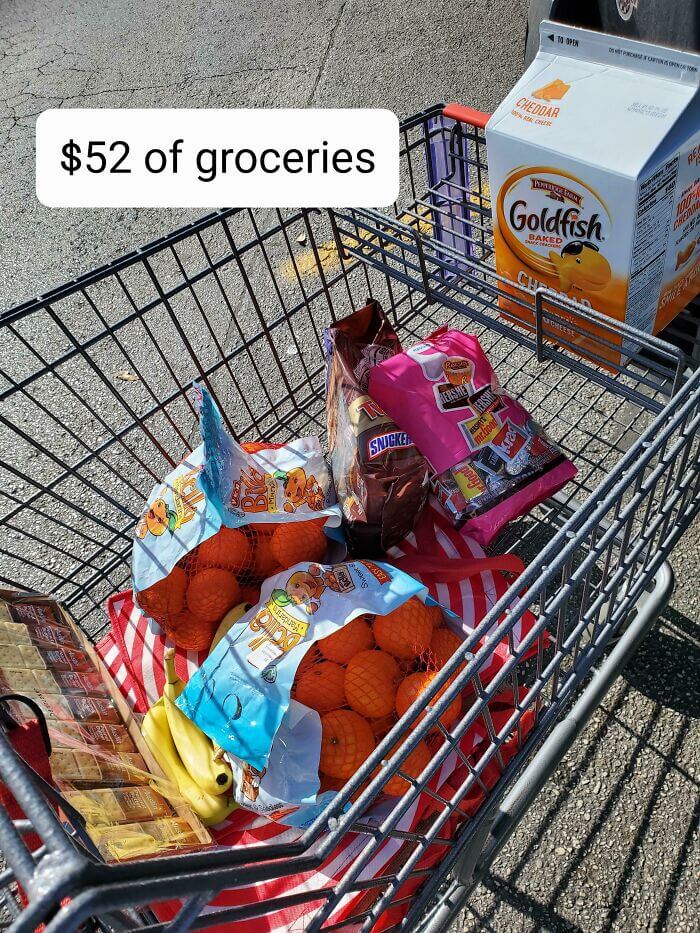

#11 I just want to give my students some snacks without going broke

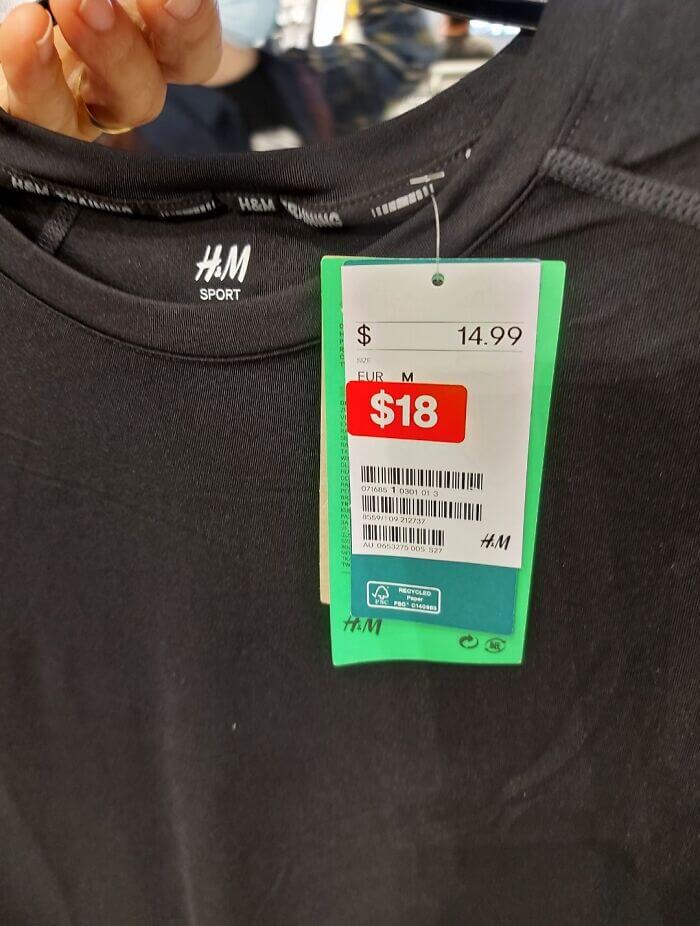

#12 Some interesting boxing day prices at H&M today

#13 Inflation has been hitting everything

#14 The picture shows 8 mozzarella sticks, I received 3. it cost $12

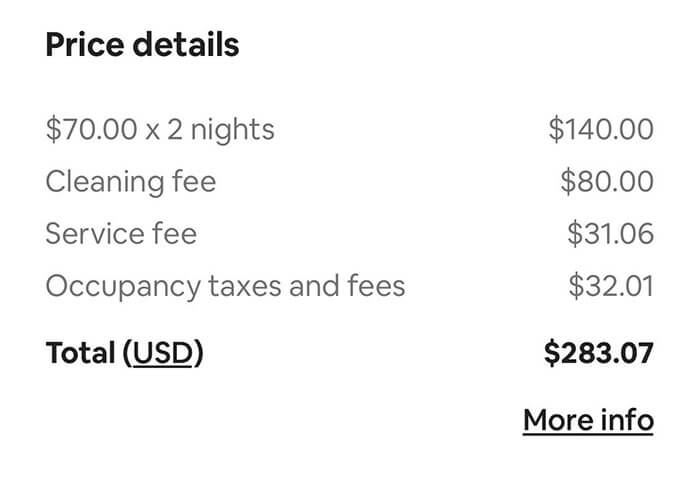

#15 Feels like false advertising. Fees and taxes are more than the room rate. airbnb

#16 A grocery store in germany has started importing Arizona ice tea cans and covering up the 99¢ with mini American flag stickers

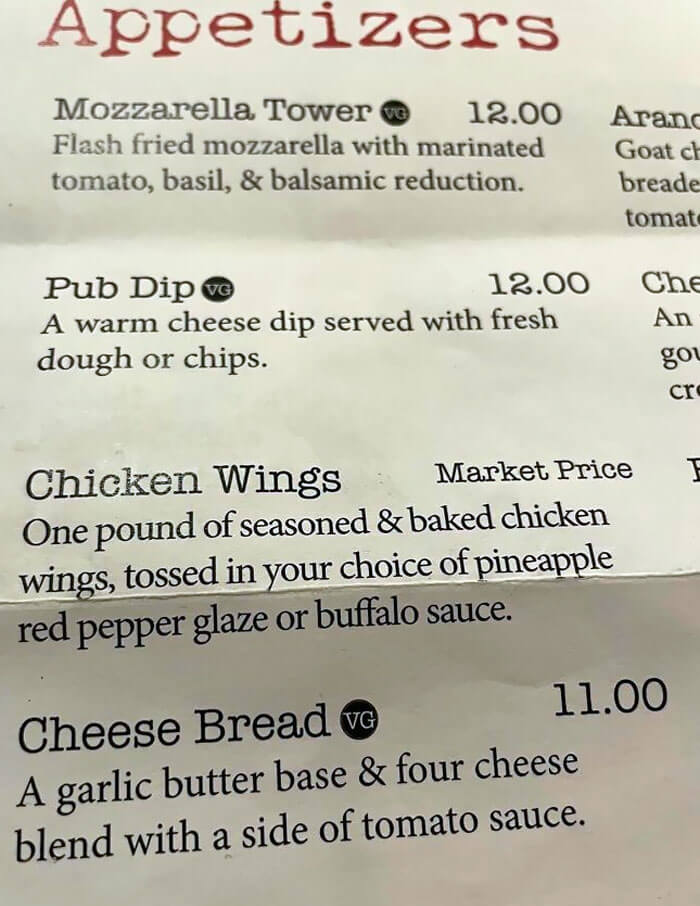

#17 You know inflation is out of control when chicken wings are "market price"

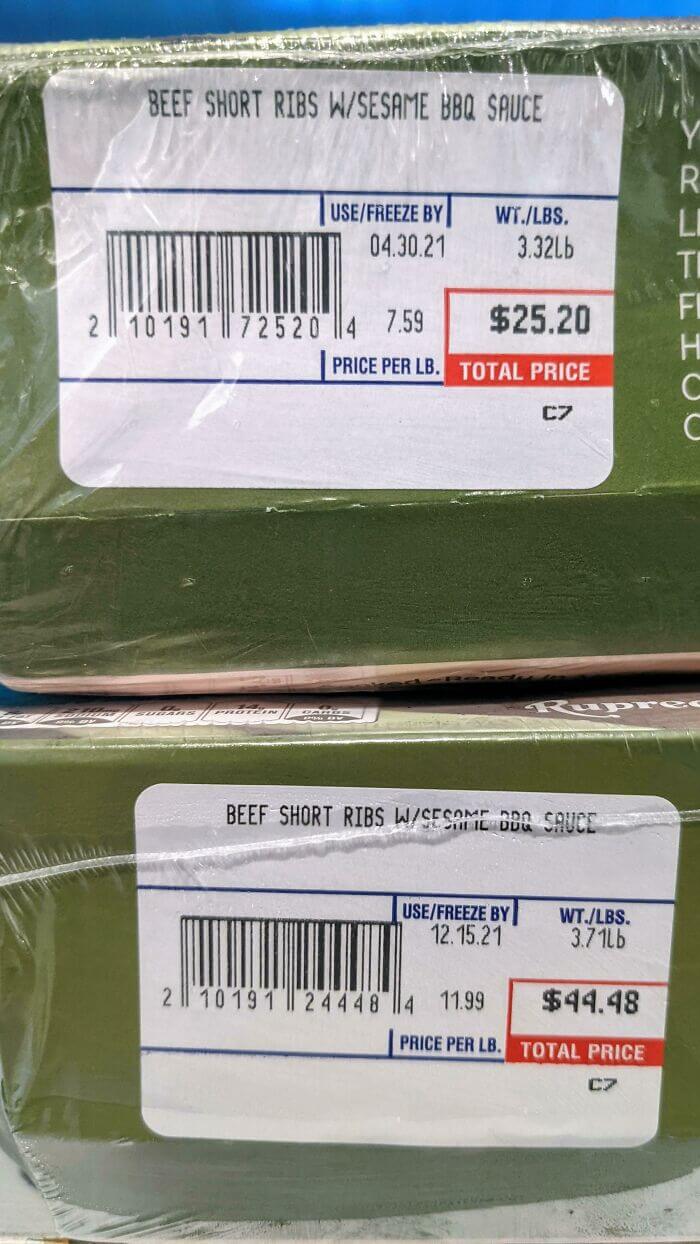

#18 Inflation measured in Costco beef rib units

#19 I've been seeing a lot of those "what $x can get you in 2022" posts. just wanted to remind those of you who have access to take advantage of the produce section. $68

Share this article

Advertisement