From an immigrant that couldn’t buy a pair of shoes for herself, how this 31-year-old budget to prepare for retirement at the age of 42?

On her walks to school as a child, Lu Wang dreamed about one day being able to afford a car of her very own so that she would no longer have to schlep through rain, snow and other elements to get where she needed to go.

The three of them lived in the student dormitory in their early years, and each year they did not have enough money to buy more than one pair of shoes for Wang, let alone drive her to school.

She recalled that when her classmates drove past her and got out of the car at the front door, she repeatedly fell on the slippery sidewalk near the school.

"One day I fell down again and I said, 'I don't care what needs to be paid, one day I will be in a warm place in the car,'" Wang told CNBC Make It

Now, Wang can afford a car — her Honda cost around $25,000, which she paid off in a single lump sum — and everything else she needs to live comfortably in San Diego, Calif. She earns around $157,000 per year as a dentist in the U.S. Navy and knows her salary will continue to increase every few years, thanks to the military’s pay scale.

In fact, she’s able to invest so much — over $6,000 a month — that she currently has a net worth of over $750,000 and is on track to retire by her early 40s.

“I’m more than comfortable right now,” she says. “I have everything I want. I have everything I need.”

"For me, that's the height of luxury," Wang said. She explained that when her parents went shopping for groceries, she was not allowed to ask for anything from her parents. "He may be the first person I know to realize the American Dream for himself."

While there, the Navy introduced the dental association of which it was a member, spoke about the benefits of joining, including travel and generous medical and retirement benefits. In addition, the Navy offered scholarship programs that paid for the dental school in full.

Shortly after she enrolled in dental school, she joined the Navy and participated in the Health Services Collegiate Program, which gave her a monthly stipend, which she used to pay tuition, textbooks, and other fees at a dental school at the University of Maryland. ... In return, she made a commitment to join the current command of the Navy as an officer for at least four years after graduation.

“I would highly recommend [this path] to anyone who’s interested in financing their education without going into debt,” she says.

Now in her ninth year in the Navy (her time in dental school counts toward her years of service), Wang plans to stick around until she’s at least until 42, when she can retire with 20 years of active duty service under her belt and receive a monthly payment from the military for the rest of her life.

Day in and day out, she is like a regular dentist: She performs routine check-ups, cleanings, and oral surgeries just like civilian professionals. The main difference: her office is sometimes a warship.

Prior to San Diego, she worked in Virginia and Japan and usually moves every few years. The Navy has also brought her to the Philippines, Hong Kong, Guam, South Korea and Australia, which she sees as an advantage in her job.

“Moving every two to three years definitely has its challenges, but overall, I still enjoy every move,” she says. "Each new location presents new challenges and learning opportunities."

With housing costs and some of her food, Ms Wang was able to use most of her take-home salary for investment. She deposits approximately US$4,000 in a brokerage account every month, and mainly holds index funds as well as some individual stocks and Dogecoin.

Every year, she also maximizes her Roth IRA and contributes to her frugal savings plan, which is the military version of 401(k), which gives her a 5% employer match.

“I don’t live a very extravagant lifestyle, so I’m able to put away quite a bit without feeling like I’m depriving myself,” she says.

Wang has around $6,000 in her checking account, which she considers her liquid savings. Adding more to that is not a priority at the moment. “I haven’t been saving regularly since the market is down and it’s a great time to buy,” she says.

Apart from her investment, the king prioritizes travel and luxury for quality food ("food is one of the greatest loves of my life," she says) and minimizes her costs. Suppress to. She doesn't own a TV. Because I want to spend time on activities that I think are more fulfilling, such as coaching young colleagues, reading about investment strategies, and spending time with friends.

“I’m very selective with what I purchase and how I spend my time now,” she says. “I don’t think I’ve ever regretted not watching TV.”

It was one of these deep infiltrations into online personal financial content that she discovered financial independence, early retirement, or a group of FIRE. Already a spartan, the idea that her lifestyle could give her options that she didn't have when she was a kid was fascinating.

Technically, Wang could retire from the Navy at the age of 42. But she is satisfied with her job; she thinks Fire's financial independence is particularly attractive, rather than focusing on early retirement.

"I want to be able to spend my time on things that really make me enjoy life," she said. This includes "slow travel", or visiting different places for three to four months at a time before moving to another place, and finally choosing one of these places to settle down for a long time.

In the end, Wang believes that adhering to the FIRE principle will ensure that she will never feel the feeling of walking to school many years ago, watching her classmates drive by her in shiny new cars.

“We all are promised one life only,” she says. “I plan on utilizing my time wisely and to live a full and enriching life of my choosing.”

Source: CNBC

Source: CNBC

The three of them lived in the student dormitory in their early years, and each year they did not have enough money to buy more than one pair of shoes for Wang, let alone drive her to school.

She recalled that when her classmates drove past her and got out of the car at the front door, she repeatedly fell on the slippery sidewalk near the school.

"One day I fell down again and I said, 'I don't care what needs to be paid, one day I will be in a warm place in the car,'" Wang told CNBC Make It

Now, Wang can afford a car — her Honda cost around $25,000, which she paid off in a single lump sum — and everything else she needs to live comfortably in San Diego, Calif. She earns around $157,000 per year as a dentist in the U.S. Navy and knows her salary will continue to increase every few years, thanks to the military’s pay scale.

In fact, she’s able to invest so much — over $6,000 a month — that she currently has a net worth of over $750,000 and is on track to retire by her early 40s.

“I’m more than comfortable right now,” she says. “I have everything I want. I have everything I need.”

Building a military career

After understanding the practical results that dentistry can provide, Wang decided to continue his studies in dentistry. When she was a child, she used to go to the grocery store with her landlord. The landlord was a Chinese American, a dentist, and a friend of her family. She was surprised to watch him fill his shopping cart with any food he liked, seemingly not considering the cost."For me, that's the height of luxury," Wang said. She explained that when her parents went shopping for groceries, she was not allowed to ask for anything from her parents. "He may be the first person I know to realize the American Dream for himself."

Source: CNBC

Source: CNBC

While there, the Navy introduced the dental association of which it was a member, spoke about the benefits of joining, including travel and generous medical and retirement benefits. In addition, the Navy offered scholarship programs that paid for the dental school in full.

Shortly after she enrolled in dental school, she joined the Navy and participated in the Health Services Collegiate Program, which gave her a monthly stipend, which she used to pay tuition, textbooks, and other fees at a dental school at the University of Maryland. ... In return, she made a commitment to join the current command of the Navy as an officer for at least four years after graduation.

“I would highly recommend [this path] to anyone who’s interested in financing their education without going into debt,” she says.

Now in her ninth year in the Navy (her time in dental school counts toward her years of service), Wang plans to stick around until she’s at least until 42, when she can retire with 20 years of active duty service under her belt and receive a monthly payment from the military for the rest of her life.

Day in and day out, she is like a regular dentist: She performs routine check-ups, cleanings, and oral surgeries just like civilian professionals. The main difference: her office is sometimes a warship.

Prior to San Diego, she worked in Virginia and Japan and usually moves every few years. The Navy has also brought her to the Philippines, Hong Kong, Guam, South Korea and Australia, which she sees as an advantage in her job.

“Moving every two to three years definitely has its challenges, but overall, I still enjoy every move,” she says. "Each new location presents new challenges and learning opportunities."

Source: CNBC

Source: CNBC

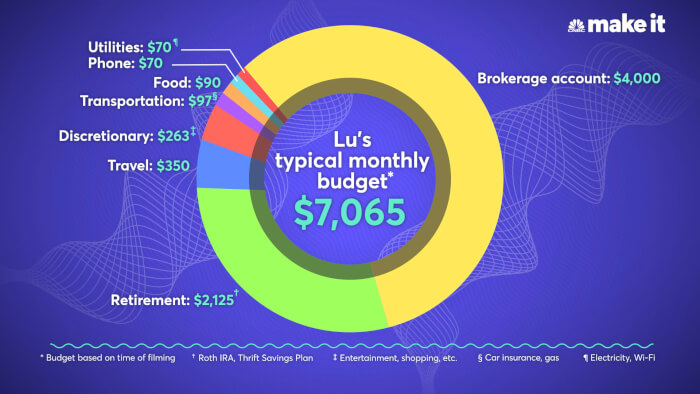

- Brokerage account: $4,000

- Retirement investments: $2,125 ($1,625 in Thrift Savings Account; $500 in Roth IRA)

- Travel: $350

- Discretionary: $263 ($200 for Entertainment expenses; $50 for shopping; $13 for Dental Officer Association fee)

- Transportation: $97 ($57 for car insurance; $40 for gas)

- Food: $90

- Phone: $70

- Utilities: $70 ($45 for Wi-Fi; $25 for heat and electricity)

With housing costs and some of her food, Ms Wang was able to use most of her take-home salary for investment. She deposits approximately US$4,000 in a brokerage account every month, and mainly holds index funds as well as some individual stocks and Dogecoin.

Every year, she also maximizes her Roth IRA and contributes to her frugal savings plan, which is the military version of 401(k), which gives her a 5% employer match.

“I don’t live a very extravagant lifestyle, so I’m able to put away quite a bit without feeling like I’m depriving myself,” she says.

Wang has around $6,000 in her checking account, which she considers her liquid savings. Adding more to that is not a priority at the moment. “I haven’t been saving regularly since the market is down and it’s a great time to buy,” she says.

Apart from her investment, the king prioritizes travel and luxury for quality food ("food is one of the greatest loves of my life," she says) and minimizes her costs. Suppress to. She doesn't own a TV. Because I want to spend time on activities that I think are more fulfilling, such as coaching young colleagues, reading about investment strategies, and spending time with friends.

“I’m very selective with what I purchase and how I spend my time now,” she says. “I don’t think I’ve ever regretted not watching TV.”

On the road to financial independence

When she started dental school at the age of 22, the king's father suggested that she start investing in some of her military scholarships. Her parents have always emphasized the importance of savings, but investing has been a whole new world. She turned to sites like YouTube and Reddit to learn more about mastering her money.It was one of these deep infiltrations into online personal financial content that she discovered financial independence, early retirement, or a group of FIRE. Already a spartan, the idea that her lifestyle could give her options that she didn't have when she was a kid was fascinating.

Source: CNBC

Source: CNBC

Technically, Wang could retire from the Navy at the age of 42. But she is satisfied with her job; she thinks Fire's financial independence is particularly attractive, rather than focusing on early retirement.

"I want to be able to spend my time on things that really make me enjoy life," she said. This includes "slow travel", or visiting different places for three to four months at a time before moving to another place, and finally choosing one of these places to settle down for a long time.

In the end, Wang believes that adhering to the FIRE principle will ensure that she will never feel the feeling of walking to school many years ago, watching her classmates drive by her in shiny new cars.

“We all are promised one life only,” she says. “I plan on utilizing my time wisely and to live a full and enriching life of my choosing.”

Share this article

Advertisement