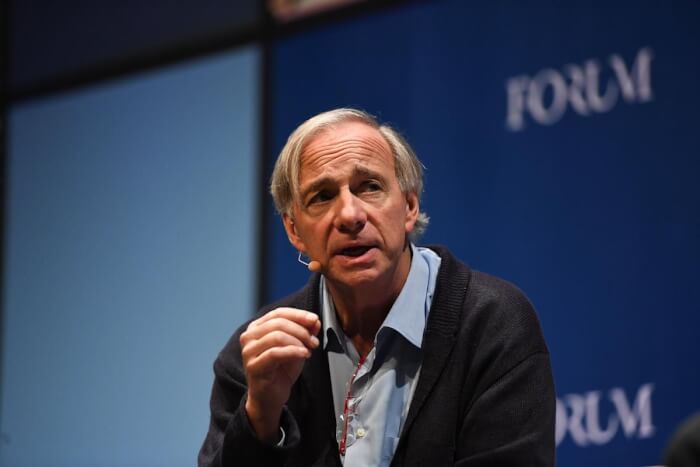

72-Year-Old Billionaire On Forthcoming Economic Disaster And 2 Tips For Investors

Ray Dalio, 72, founder of the world's largest hedge fund Bridgewater Associates, is warning of another impending financial crisis and offering advice to prepare for the future.

Now he is warning of another impending economic disaster and offering advice to prepare for the future. "I think we’re at risk of a war with China. Largely due to misunderstandings," Dalio told CNBC.

Dalio noted that his prediction isn’t a fact. He had also made wrong predictions in the past. But he also said a future disaster is inevitable, given what has happened over the past 500 years.

In other words, if the upcoming US-China conflict doesn't affect the economy, then there's another problem. This is why Ray Dalio thinks disaster is near and offers 2 tips for future preparations.

This could further escalate the US-China trade war. Trade tensions between the two countries began with the Trump administration in 2018, leading to US companies cutting wages, reducing profit margins and increasing consumer prices.

Moody's research indicates that the trade war cost the US at least 300,000 jobs in its first year alone. In 2020, the Federal Reserve Bank of New York found that the trade war has cost American companies about $1.7 trillion in market capitalization. Ray Dalio expressed hope that the US and China would stay away from the brink of conflict.

Anxiety prompts each person to scrutinize their own personal risks and encourages action, he said.

For example, "places to live" is also a type of risk. In Dalio's book, he mentioned the "Health Index", which evaluates more than 10 countries based on 18 different factors such as debt burden, military strength and economic output. This index helps readers assess risks and form strategies where they live and invest.

Similarly, Dalio also advised investors to assess financial risk in inflation-adjusted terms rather than dollar terms. But that doesn't mean people should just choose other investments over savings or vice versa. Amid the turmoil, Dalio says emergency savings should be backed by a safe and diversified portfolio.

Be sure not to "put all your eggs in one basket", he stressed. He recently told CNBC that cash is no longer a safe investment as inflation has hit a 31-year high in the US.

Instead, he advises building a portfolio as diversified as possible, from bonds to gold. Portfolios can even include digital assets like cryptocurrencies. In May, Ray Dalio told CoinDesk that he personally owns a "small amount" of Bitcoin, despite his longstanding criticism of the cryptocurrency. The reason he gave was for the purpose of diversifying his portfolio.

H/T: cnbc.com

Source: Reuters

Source: Reuters

Now he is warning of another impending economic disaster and offering advice to prepare for the future. "I think we’re at risk of a war with China. Largely due to misunderstandings," Dalio told CNBC.

Dalio noted that his prediction isn’t a fact. He had also made wrong predictions in the past. But he also said a future disaster is inevitable, given what has happened over the past 500 years.

In other words, if the upcoming US-China conflict doesn't affect the economy, then there's another problem. This is why Ray Dalio thinks disaster is near and offers 2 tips for future preparations.

Reasons Dalio believes for a worse outcome of US-China trade war

Source: Getty Images

Source: Getty Images

This could further escalate the US-China trade war. Trade tensions between the two countries began with the Trump administration in 2018, leading to US companies cutting wages, reducing profit margins and increasing consumer prices.

Moody's research indicates that the trade war cost the US at least 300,000 jobs in its first year alone. In 2020, the Federal Reserve Bank of New York found that the trade war has cost American companies about $1.7 trillion in market capitalization. Ray Dalio expressed hope that the US and China would stay away from the brink of conflict.

Tip #1: Financial risk assessment

Source: Getty Images

Source: Getty Images

Anxiety prompts each person to scrutinize their own personal risks and encourages action, he said.

For example, "places to live" is also a type of risk. In Dalio's book, he mentioned the "Health Index", which evaluates more than 10 countries based on 18 different factors such as debt burden, military strength and economic output. This index helps readers assess risks and form strategies where they live and invest.

Similarly, Dalio also advised investors to assess financial risk in inflation-adjusted terms rather than dollar terms. But that doesn't mean people should just choose other investments over savings or vice versa. Amid the turmoil, Dalio says emergency savings should be backed by a safe and diversified portfolio.

Tip#2: Save and diversify your portfolio

Source: Getty Images

Source: Getty Images

Be sure not to "put all your eggs in one basket", he stressed. He recently told CNBC that cash is no longer a safe investment as inflation has hit a 31-year high in the US.

Instead, he advises building a portfolio as diversified as possible, from bonds to gold. Portfolios can even include digital assets like cryptocurrencies. In May, Ray Dalio told CoinDesk that he personally owns a "small amount" of Bitcoin, despite his longstanding criticism of the cryptocurrency. The reason he gave was for the purpose of diversifying his portfolio.

H/T: cnbc.com

Share this article

Advertisement