This Staggering Lady Bought Nothing For An Entire Year And Ended Up Saving $23,000

She wasn't stingy or poor. On the contrary, she had a proper job with a stable salary that could help her keep a comfortable lifestyle. Michelle McGagh was a personal financial journalist in London. For ten years, she had spent a lot of money on luxurious yet inessential things. From expensive shoes, dresses, and fashion clothes to restaurants and eateries, cinemas, and so on, she had enjoyed buying stuff and going places that pleased her.

Source: @TEDxManchester

Source: @TEDxManchester

Source: tash

Source: tash

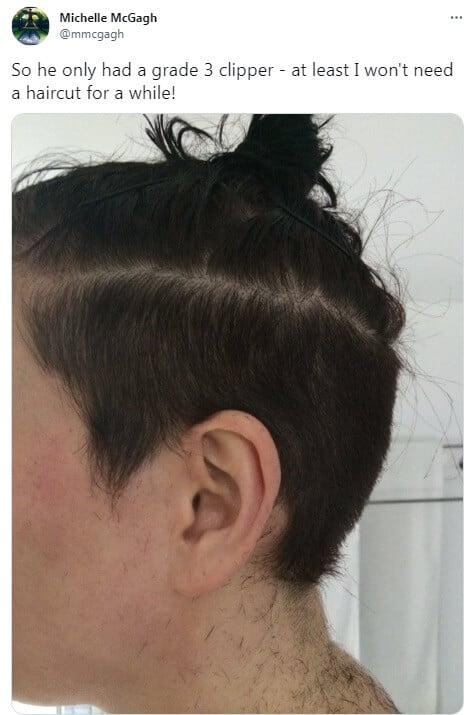

Source: @mmcgagh

Source: @mmcgagh

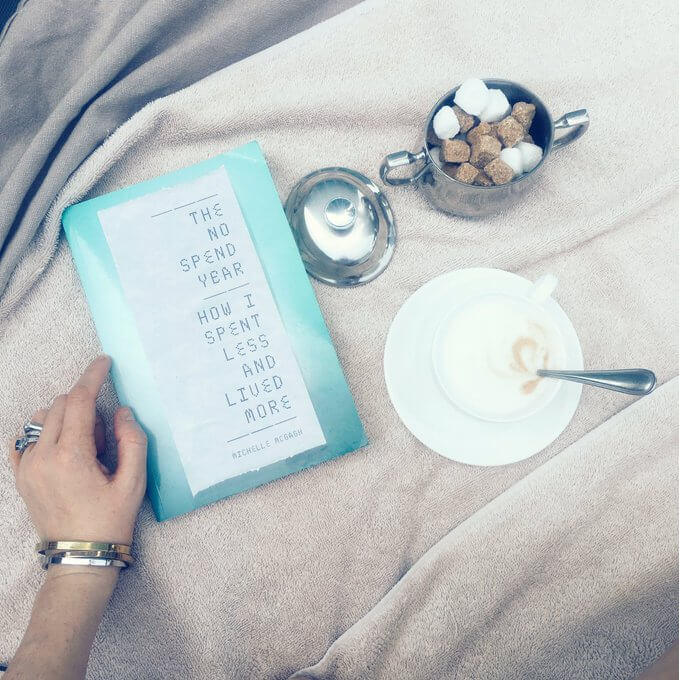

Source: @mmcgagh

Source: @mmcgagh

Source: @mmcgagh

Source: @mmcgagh

Source: @mmcgagh

Source: @mmcgagh

Source: @G_Champomier

Source: @G_Champomier

Source: @mmcgagh

Source: @mmcgagh

Source: @sjdelagarde

Source: @sjdelagarde

Source: @ChrisRossRadio

Source: @ChrisRossRadio

Share this article

Advertisement